Clover POS for FFLs: How to Use Clover Without Risking Your Merchant Account

Why most FFLs are told “no” to Clover and how EPIC Merchant Systems makes it work with 2A-friendly banks

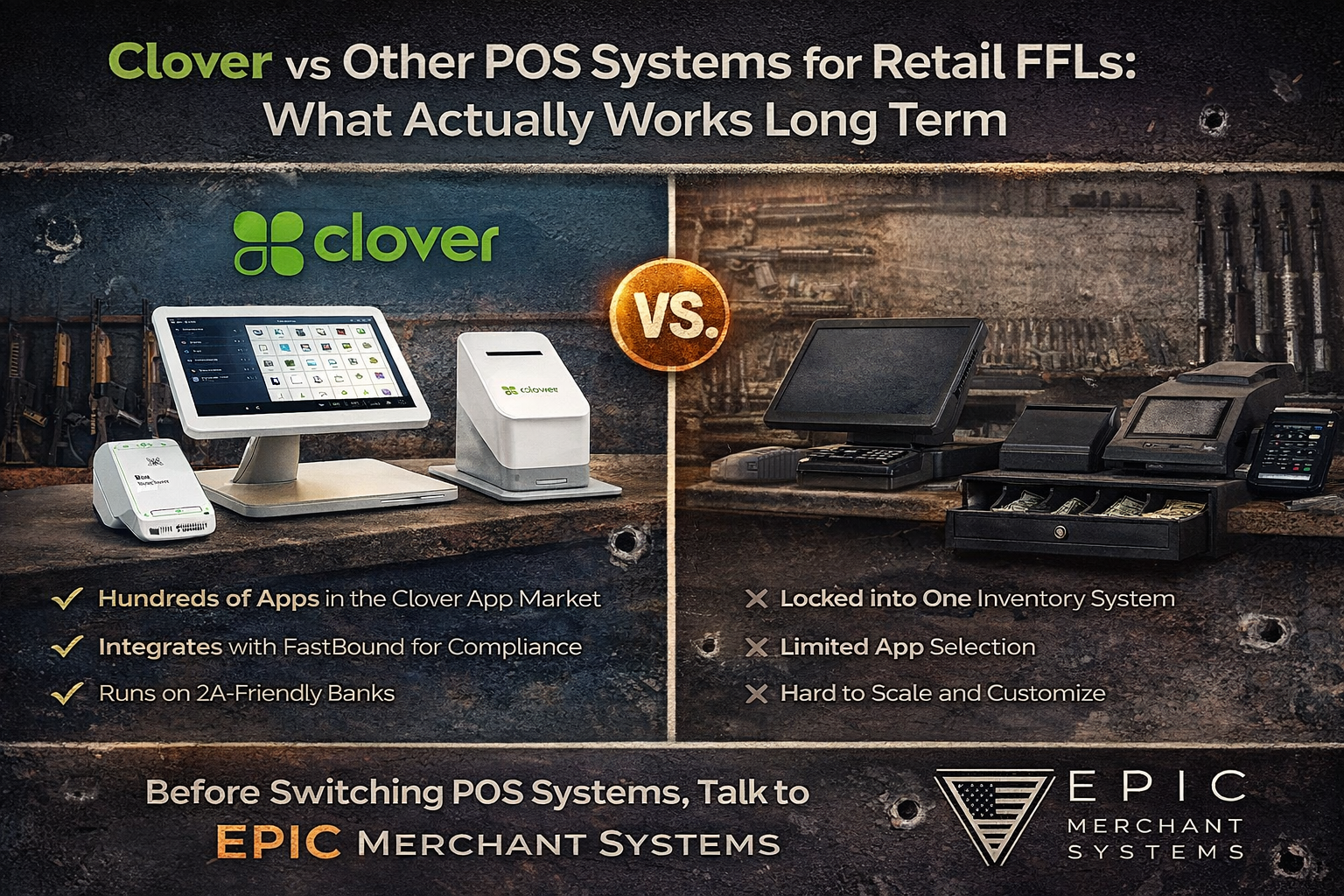

Clover POS and Why So Many Retail Businesses Choose It

Clover has become one of the most widely adopted point-of-sale systems for retail businesses across the country.

It offers a modern interface, reliable hardware, fast checkout, inventory tracking, and access to a powerful app ecosystem. For many retailers, Clover is easy to deploy and easy to scale.

For FFLs and other Second Amendment-aligned businesses, Clover adoption is often misunderstood and frequently mishandled.

Why Most FFLs Are Denied or Shut Down on Clover

Clover itself is not the problem.

The issue is how Clover merchant accounts are underwritten and boarded.

Many payment providers use banks that will not support FFLs, fail to properly disclose regulated retail activity, or board Clover accounts under incorrect business categories. These accounts may appear approved at first, only to be flagged later during monitoring.

This leads to sudden account freezes, terminations, and withheld funds.

As a result, many FFLs are incorrectly told that Clover is not allowed for their business. In reality, Clover can be used successfully when it is set up correctly from the start.

The Difference Between Clover the POS and the Bank Behind It

Clover is a point-of-sale platform. It does not approve or deny businesses.

The acquiring bank behind the merchant account makes that decision.

If the bank is not 2A-friendly, has internal restrictions on FFLs, or was not given full disclosure during underwriting, the account will eventually be flagged.

This is where most Clover implementations fail.

How EPIC Merchant Systems Makes Clover Work for FFLs

EPIC Merchant Systems specializes in payment processing for FFLs and other regulated retail businesses nationwide.

We do not attempt to force Clover through banks that are not aligned with your business model.

Instead, we work exclusively with gun-friendly and 2A-friendly acquiring banks, fully disclose FFL operations during underwriting, and configure Clover based on how you actually sell.

This approach dramatically reduces the risk of shutdowns and interruptions.

Clover POS Benefits for FFL Retail Locations

When set up correctly, Clover provides powerful advantages for FFL storefronts and multi-location operations.

Clover supports fast in-store transactions with EMV and contactless payments, barcode scanning, customer-facing displays, and detailed receipts.

Inventory can be tracked at the item level with categories, SKU reporting, and low-stock alerts, which is critical in regulated retail environments.

Clover hardware options include Clover Station, Clover Mini, Clover Flex, and Clover Go, allowing businesses to design a checkout experience that fits their space and workflow.

Clover also supports centralized reporting and consistent pricing across multiple locations when configured properly.

The Clover App Market Advantage for FFLs

One of Clover’s most powerful features is access to the Clover App Market.

This allows FFLs to extend the functionality of their POS system without custom development or expensive enterprise software.

When paired with the right bank and underwriting, Clover apps transform the POS into a flexible retail platform.

Popular Clover App Categories Used by FFLs

FastBound Integration Through Connector for FastBound

Connector for FastBound allows you to make a seamless connection between FastBound and Clover, creating a direct link between compliance tracking and point-of-sale activity.

With this connection in place, any acquisitions created in FastBound automatically create new or updated inventory items inside Clover. Creating dispositions in FastBound results in pending orders within Clover. Connector for FastBound keeps items synchronized as you add, edit, or remove items from the disposition record.

This integration eliminates duplicate data entry, reduces operational errors, and helps maintain inventory accuracy across systems.

When properly configured, FastBound and Clover work together instead of operating as separate workflows.

Additional Popular Clover App Categories for FFLs

Beyond compliance connectivity, many FFLs use Clover apps for inventory management, customer relationship management, employee permissions and scheduling, accounting integrations, loyalty programs, and advanced reporting.

The Clover App Market allows businesses to tailor their POS to how they actually operate rather than forcing them into a generic retail structure.

Why Clover App Integrations Matter for Long-Term Stability

Many account issues occur when point-of-sale systems, inventory tools, and compliance software operate independently.

Disconnected systems increase the risk of data mismatches, inventory errors, and transaction inconsistencies that draw unwanted scrutiny from processors and banks.

By combining Clover, Connector for FastBound, and 2A-friendly banking through EPIC Merchant Systems, FFLs gain a POS setup designed for long-term stability and scalability.

Who This Clover Setup Is Designed For

EPIC’s Clover solutions are ideal for FFL retail storefronts, ammunition-focused retailers, accessory and equipment shops, ranges, training facilities, and multi-location Second Amendment-aligned businesses.

If you sell in person and want a modern POS without risking your merchant account, this setup matters.

Clover POS for FFLs: Questions and Answers

Can FFLs use Clover POS?

Yes. FFLs can use Clover POS when the system is set up through a provider that works with 2A-friendly banks and properly discloses the business model during underwriting.

Why do Clover accounts for FFLs get shut down?

Most shutdowns occur because the account was approved under the wrong business category or through a bank that does not support regulated retail.

Is Clover itself considered high risk for FFLs?

No. Clover is a POS platform. Risk is determined by the bank and how the account is structured.

Can Clover integrate with FastBound?

Yes. Clover integrates with FastBound using Connector for FastBound, keeping inventory and transaction data synchronized between systems.

Does the FastBound integration replace compliance software?

No. FastBound remains the system of record. The integration simply keeps POS and compliance data aligned.

What Clover hardware works best for FFL retail locations?

Most FFLs use Clover Station or Clover Mini for primary checkout, with Clover Flex for mobility.

Is Clover suitable for multi-location FFL businesses?

Yes, when underwritten correctly and configured properly.

Why should FFLs avoid generic Clover signups?

Generic signups often involve banks that do not support regulated retail and provide no guidance, increasing shutdown risk.

How does EPIC Merchant Systems reduce risk?

By using 2A-friendly banks, fully disclosing operations, and structuring accounts correctly from day one.

Final Thoughts

Clover is not the risk. Improper setup is.

When Clover is paired with the wrong bank or incomplete underwriting, problems are inevitable. When Clover is set up correctly with 2A-friendly banks and proper disclosure, it becomes one of the most powerful retail POS platforms available to FFLs.

EPIC Merchant Systems exists to ensure it is done right the first time.

Get after it with EPIC Merchant Systems

Looking to use Clover in your retail location without risking shutdowns or disruptions?

EPIC Merchant Systems provides Clover POS systems backed by 2A-friendly banks and FFL-safe underwriting.